This program consists of four courses, all of which are aligned with national standards from the Jump$tart Coalition for Personal Financial Literacy.

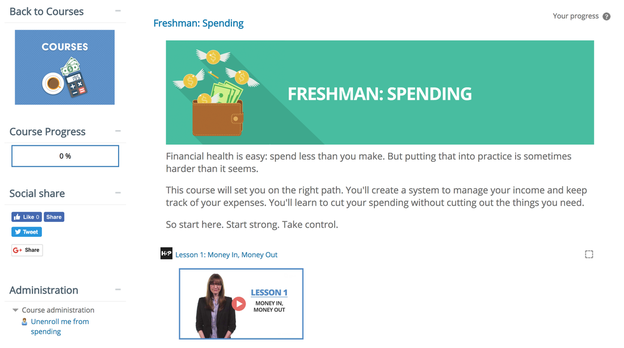

Students begin with the “Freshman: Spending” course, which consists of two videos, a quiz, and a place to take notes. I would recommend opening the video in a new tab, so that you can keep your notepad open if you’re using it. The videos also contain questions throughout in order to check-in on understanding while students are watching.

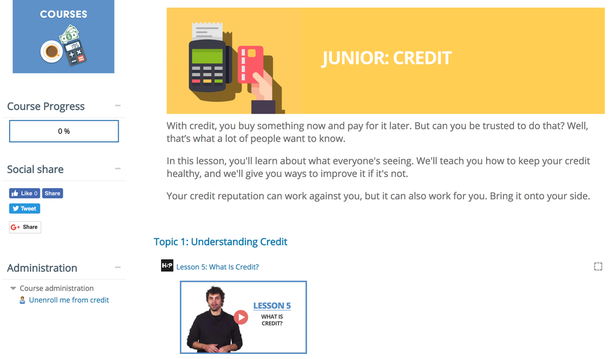

After completing the Freshman level, students move on to the Sophomore, Junior, and Senior levels. Each level consists of a series of videos with embedded questions, as well as a final quiz. Overall, the lessons provide a solid, but quick, introduction to concepts of personal financial literacy such as budgeting, saving, and credit.

One important thing to point out, is these courses are designed for college students and high school students who are planning on living on their own soon. Because of this, these courses offer great introductory financial lesson for adults, and soon to be adults. In other words, I wouldn’t recommend these courses to high school freshmen and sophomores.

Overall, these courses provide an important overview to personal financial literacy that many students might not otherwise receive. It’s unfortunate that financial literacy is so often overlooked in the secondary curriculum, and it’s great to see a resource designed with this audience in mind.

OppU’s free collection of personal financial literacy lessons are an excellent resource for any teacher, parent, or student looking to increase their knowledge on these important topics. You can check out the courses from OppU here.

The opinions expressed in this review are my own.

I was not compensated for writing this review.

RSS Feed

RSS Feed